在不久前国际货币基金组织的年会上,世界各国的央行行长和财政部长济济一堂,讨论如何协调一致,避免全球货币战争。最近,一些央行纷纷干预汇市,防止本国货币升值,全球货币市场紧张局势不断升温。许多国家特别需要令其货币贬值,以振兴出口,以帮助其国内经济。当经济复苏乏力,且未来面临不确定性时,这种策略尤其常见。不幸的是,这种策略行之有效的前提是,别国不采取相同的策略。我相信现在有人正唏嘘不已,后悔没为这种策略申请专利,或没能将其秘不示人。

因为这种策略在每一本经济学教科书中都能找得到,而且几乎每个国家都需要依靠出口推动国内经济增长,因此我们看到全球货币都在竞争性贬值。特别是由于美元政策极其宽松,因此成为其他货币贬值的诱因。但他们必须找到一些即将升值的货币,这样他们的货币才可以贬值。

很明显,人民币过去的升值压力很大。但当我研究了货币估值模型,并研究了经济数据之后,我发现的信息和得出的结论和报纸说的完全相反。

事实上,我发现人民币被高估,而且应对美元贬值。

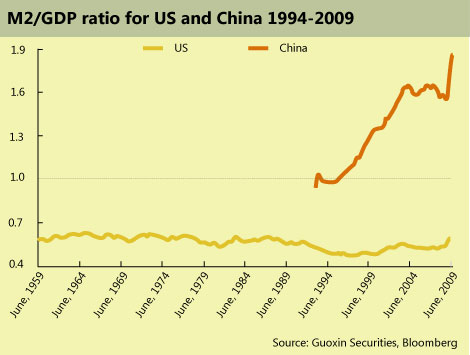

首先,让我们比较人民币和美元的货币供应量。在前两年,中国的货币政策非常宽松。根据货币数量理论,货币价值和流通货币量成反比。如果央行将流通货币量翻番,货币单位价值将减半。

2008年1月至2010年6月,中国M2货币增长61%。而同一时期,美国M2货币增长14%。在一种货币的增发速度远远大于另一种货币的情况下,它怎么可能升值呢?诚然,中国的GDP增长的确快于美国。

那再说说GDP增长。中国M2和GDP增长之差为42%,而美国为19%。人民币是不是应该相对于美元贬值23%?

人民币/美元汇率已由2008年1月的7.3:1调整为2010年10月的6.7:1。我发现这种调整令人不解。因为中国的货币政策比美国更为宽松,人民币应该贬值。

再让我们看看汇率是如何确定的。购买力平价证明,同等的国外商品和服务应在同一价值交易,前提是剔除运输成本,而且假设商品可自由买卖。汇率就是同等商品在两个国家的价格比率。人民币和美元也是一样,我们可以通过一篮子商品的人民币标价和美元标价计算出人民币/美元的公平汇率:

人民币/美元(汇率)=人民币价格/美元价格

比如:一袋马铃薯售价为1美元,而同一袋土豆卖7元人民币,“公平汇率”就应是7:1,也就是7元人民币兑换1美元。

经常有人说,人民币兑美元的汇率被低估了,并经常举例说明其说法的正确性。例证之一是比较主要国家麦当劳餐厅“巨无霸”汉堡的价格。假设“巨无霸”汉堡应在全世界以同一价值出售,它就可以被用作比较实际购买力的参考值。

根据2009年7月24日出版的《经济学人》杂志,一个“巨无霸”汉堡售价为3.57美元,中国卖12.5元。根据我们上面的公式,以购买力平价为基础的隐含汇率为:人民币/美元比价为12.5÷3.57 ,即3.5元人民币兑换1美元。

如果名义汇率为1美元兑换6.85元人民币,那结论就是:人民币被“低估”了48%!

国际货币基金组织总裁多米尼克•斯特劳斯-卡恩此前曾表示,人民币是被“显著低估”,维持相对灵活的外汇政策符合中国的最佳利益。我不知道国际货币基金组织是怎么计算的。若要对两种货币公平的进行估价,经济学家需要在两个国家确定一篮子商品。这个篮子要足够大,而且要有足够的代表性。我不知道国际货币基金组织计算用的篮子里有哪些商品。公众对这个篮子里盛的是什么商品一无所知。

现在让我再举几个例子,告诉你与此完全不同的情况:

——一辆宝马3系轿车的平均售价为45000美元,在北京卖人民币48万元。公平汇率应该是480K÷45K =11元人民币:1美元。如以宝马车计算,人民币被高估了55%!

——1品脱班杰利巧克力冰淇淋在北京的售价为60元,纽约卖3.89美元。名义汇率应为60÷3.89 =15元人民币:1美元。相比6.85的名义汇率,以冰淇淋计算的人民币汇率被高估了150%!

我相信,北京许多同等商品和服务的价格都比纽约贵。我没有资源,无法在美国和中国选择一篮子商品来进行比较,确定1元人民币和1美元的真正购买力。

我认为,生硬的断言人民币被“高估”,无法说服任何决策者,也无助于解决贸易平衡问题。也许,宝马3系轿车和班杰利冰激凌实属例外。但它们代表了经济的一方面,证明人民币确实被高估了!

消费者花钱购买成千上万的商品与服务。上至宝马轿车,下至“巨无霸”汉堡,消费商品包罗万象。实际汇率很难计算。这一切都取决于篮子里到底包括哪些商品,以及如何进行抽样统计。如果经济学家们无法就中美一篮子同等商品的内容达成一致,基于购买力平价的公平汇率的计算就是稀松平常的算术游戏。因此,人民币被低估的说法难以自圆其说。

Jeff Lu 耶鲁大学北京俱乐部

http://english.caing.com/2010-11-16/100199156.html

Regional Asian central banks have swiftly intervened to prevent the appreciation of their currencies, fanning tensions in an already heated global currency discussion. But the use of currency depreciation to revive exports only serves to introduce greater uncertainty and puts economies on a path toward weak recovery.

The stimulation of exports to promote economic growth remains an essential pattern of growth for countries around the world. Because of this, several economies have made reciprocal moves to depreciate their currencies. And yet with so many central banks echoing similar stances, one has to ask what currencies will be spared from these measures.

But beyond this, it's important to examine the root premise of these actions. Much has been made of China's currency exchange policies. At the issue's core, I believe that the yuan should be revalued – further downward in relation to the dollar.

Firstly, let's look at the money supply of the yuan and dollar. In last two years, China implemented a very loose monetary policy. According to quantity of money theory, the value of a currency is inversely proportional to the quantity of money in circulation. If a central bank doubles the amount of money in circulation, the unit value of the currency should be halved.

Comparison between U.S. and China from January 2008 to June 2010

In China,M2money growth was 61 percent from January 2008 to June 2010. And M2 of the dollar grew at 14 percent during the same period. Why should a currency appreciate when it is being printed in faster speed than another one? It is true that China'sGDPgrew faster than the U.S. GDP.

But even after adjusting for GDP growth, the spread between M2 growth and GDP in China was 42 percent, versus the spread of 19 percent in US. Using this measure, shouldn't the yuan be devalued by 23 percent relative to the dollar?

|

The exchange rate of the yuan to the dollar was adjusted from 7.3 yuan : US$ 1 in January 2008 to 6.7 yuan : US$ 1 in Oct 2010. This adjustment was strange because it did not account for China's monetary policy.

And secondly, let's find out how the exchange rate is determined. The factoring in of purchasing power parity says that same foreign goods and services should be traded at the same value, excluding transportation costs and assuming goods are freely traded. The exchange rate is the ratio of the price in two countries for the same item of goods. Between the yuan and dollar, we can calculate the fair of yuan/dollar exchange based on a basket of goods that are priced in yuan versus the same basket of goods priced in dollars.

Exchange rate of yuan/dollar = yuan price/dollar price

If a bag of potatoes sells for 1 dollar, and same bag of potatoes sells for 7 yuan, the "fair" exchange rate is 7:1 yuan, or 7 yuan: 1 dollar.

The IMF's Managing Director Dominique Strauss-Kahn, has recently said that the yuan is "significantly undervalued" and it is in Beijing's best interest to have a less rigid foreign exchange policy. To conduct a fair valuation of two currencies, economists need to create a basket of goods that is big enough and representative enough of two countries. I do not know what are included in the baskets of goods IMF used for calculation. That basket is a dark box to the public.

Let me present two examples that tell a different story:

● The average BMW 3 series sells for US$ 45,000, and for 480,000 yuan in Beijing. The fair exchange rate is 480K/45K=11 yuan/dollar. On this basis, the yuan is 55 percent over-valued based on a BMW car!

● One pint of Ben & Jerry's chocolate ice cream sells for 60 yuan in Beijing, and US$ 3.89 in New York. Nominal exchange rates are 60/3.89=15 yuan/dollar. Versus the nominal exchange rate of 6.85, the yuan is 150 percent of over-valued based on ice cream!

Many identical goods and services are more expensive in Beijing than in New York.

Besides ice cream and cars, the calculating the real exchange rate would require the inclusion of many other types of goods and services. But the items that are included in the basket, and how the sampling is drawn – can all be easily contested. The calculation of a fair exchange rate based on a PPP that economists from both sides of the Pacific can agree upon is really anyone's game.

Government interventions bring unnecessary deadlock on an issue that could easily be solved in the marketplace. The best mechanism to determine exchange rate policy is for the market to decide by supply and demand.

However, in an era of greater regulation and intervention, it seems we will only have to sit through more squabbling between various governments.

The author is a member of Yale Club of Beijing Yale Club of Beijing

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号